More than enough ink has been spilled around the role that artificial intelligence (AI) can play across the entire gamut of finance and accounting operations. A good chunk of the wordage has dwelt around near-term trends or technical requirements for future-proofing. However, when it comes to understanding the real impact of artificial intelligence in mundane daily operations, often the only source material relates to caselets that proponents of this growing technology trend throw at us from time to time.

What exactly is AI and how does it impact accounting?

Before getting into specifics, it would be helpful to understand what exactly is AI? That no one quite agrees on a fixed definition is indicative of both the complexity of the technology as well as time it takes to develop and test use cases. At the core, artificial intelligence is a suite of technologies run on predictive power that exhibit autonomous learning capabilities. These include pattern recognition, anticipation of future events and rules thereof, enable data-led decision-making and communicate them effectively.

Now, if we were to use this as an established definition for the moment, consider how these AI capabilities have changed the journey across the finance and accounting activities. A recent report by Deloitte shares how the company uses AI across business functions, from recruitment and talent acquisition to improving billing cycles and invoice processes. At the heart of all these changes is data and the standardization of templates that allows AI to mix-and-match information before throwing out options.

Enhance efficiencies, reduce time and become smarter

For some years now, the use of AI for improved accuracy in data analysis and transaction management has straddled the accounting industry. Use of AI in this industry is projected to grow at a CAGR of 30% between now and 2027, according to data shared by Mordor Intelligence. Currently, AI has found use cases across multiple accounting functions such as bookkeeping, data entry and reconciliations. A growing suite of AI-based tools have proven to be an invaluable asset for finance professionals, helping them to make better and faster decisions through the use of high quality datasets.

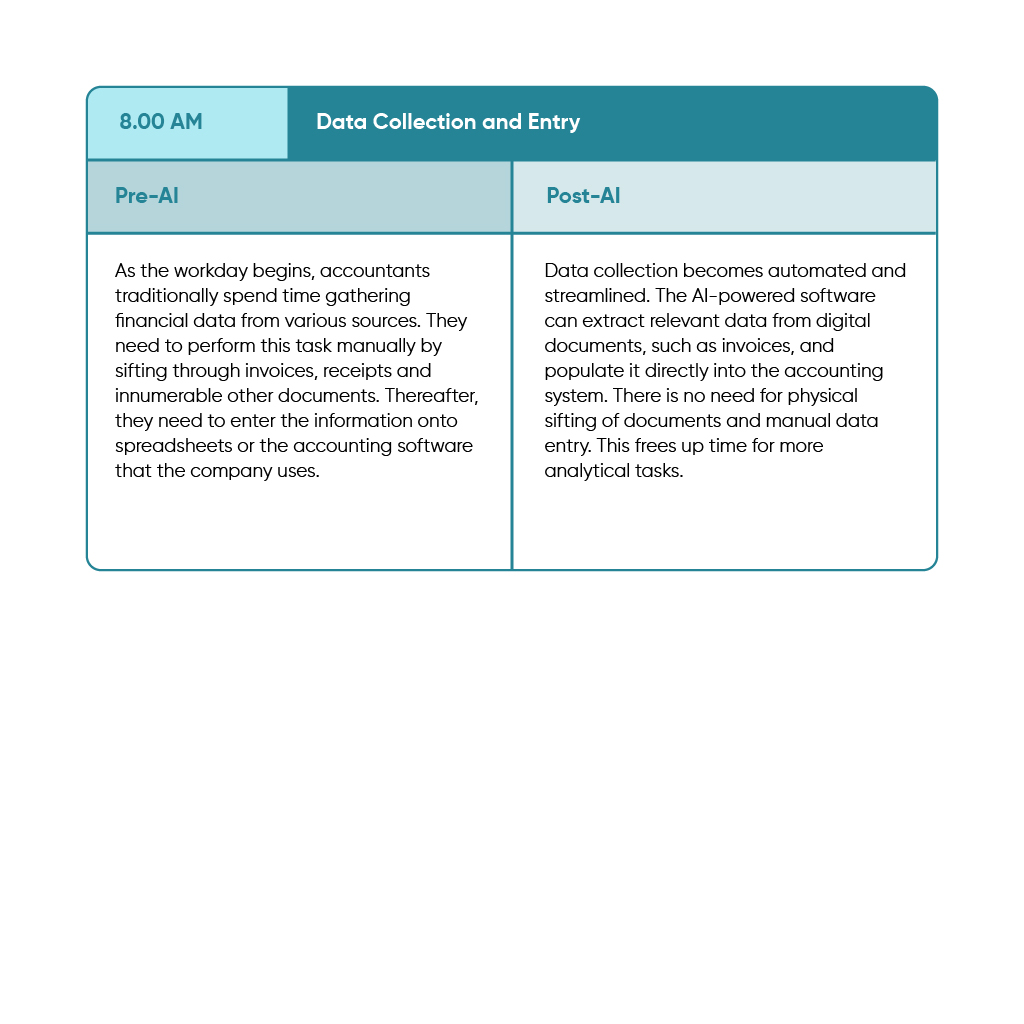

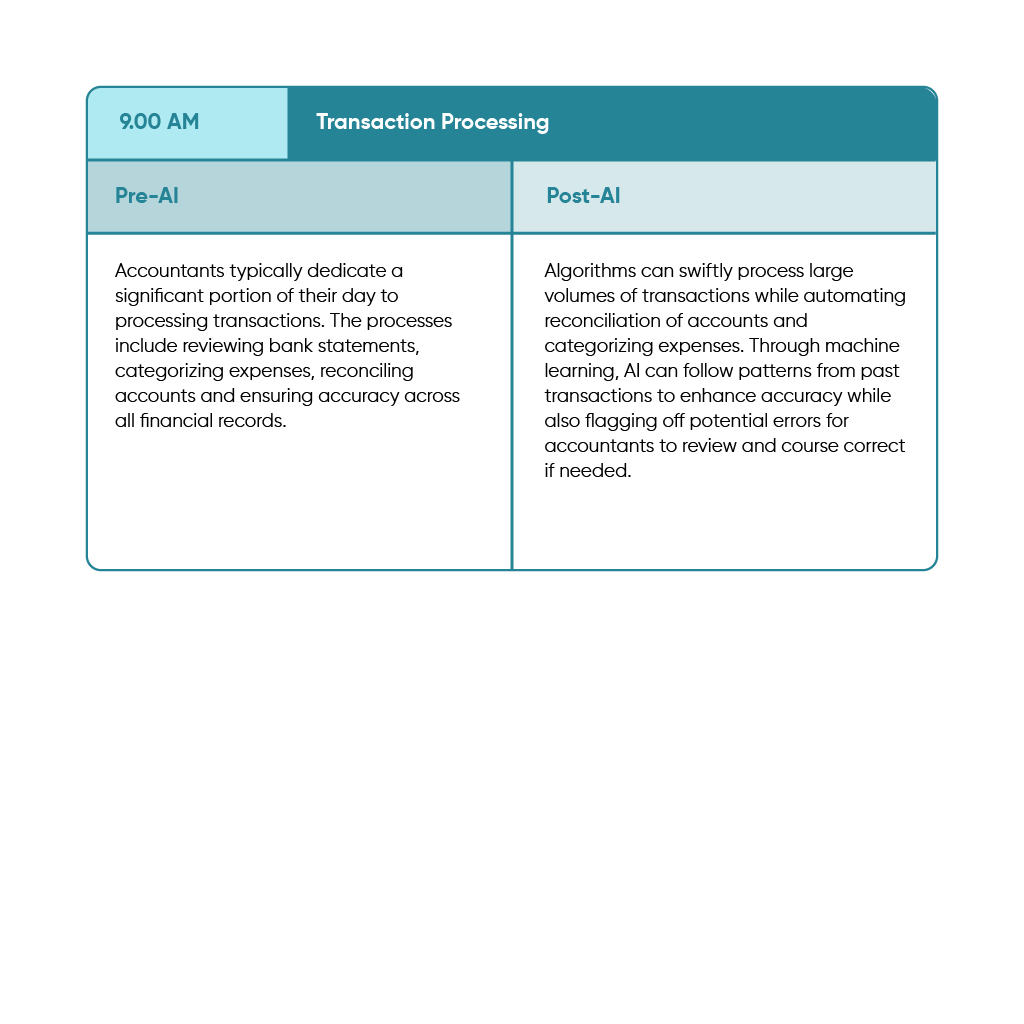

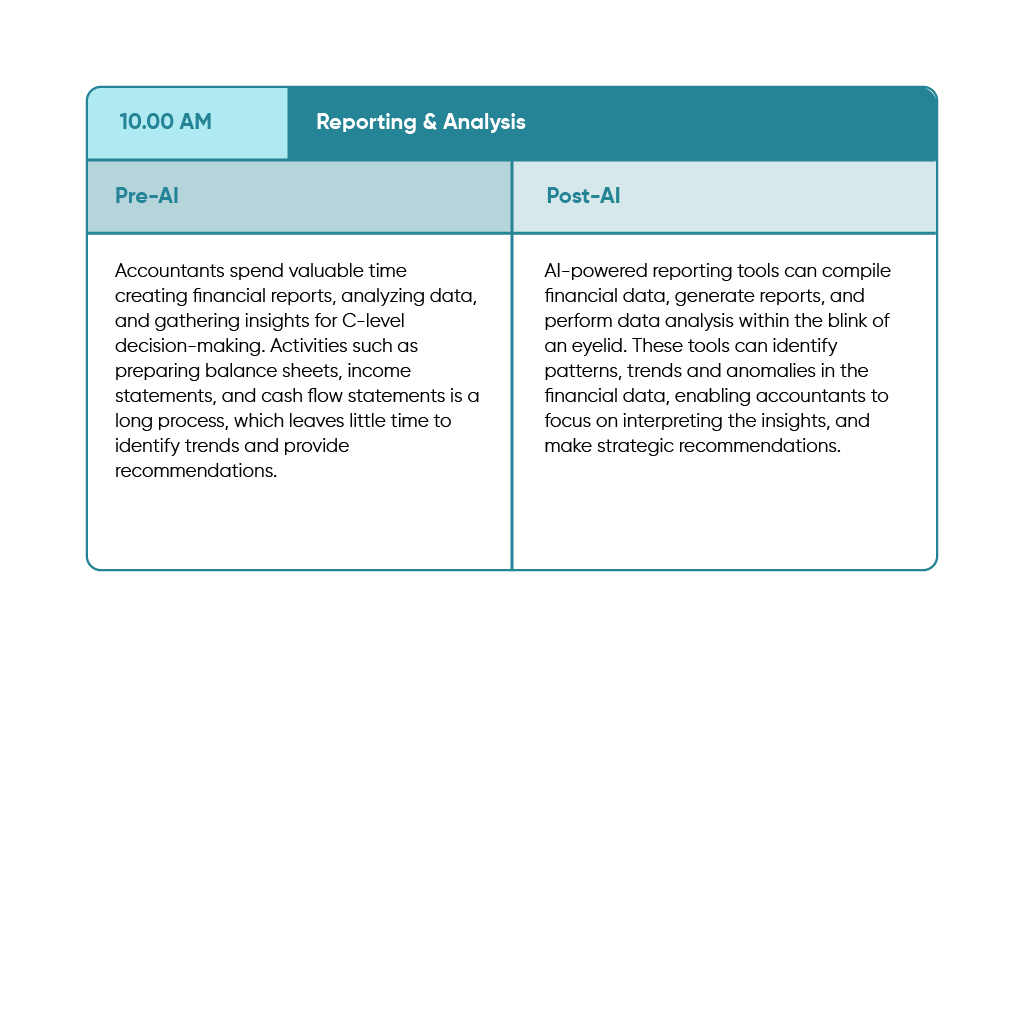

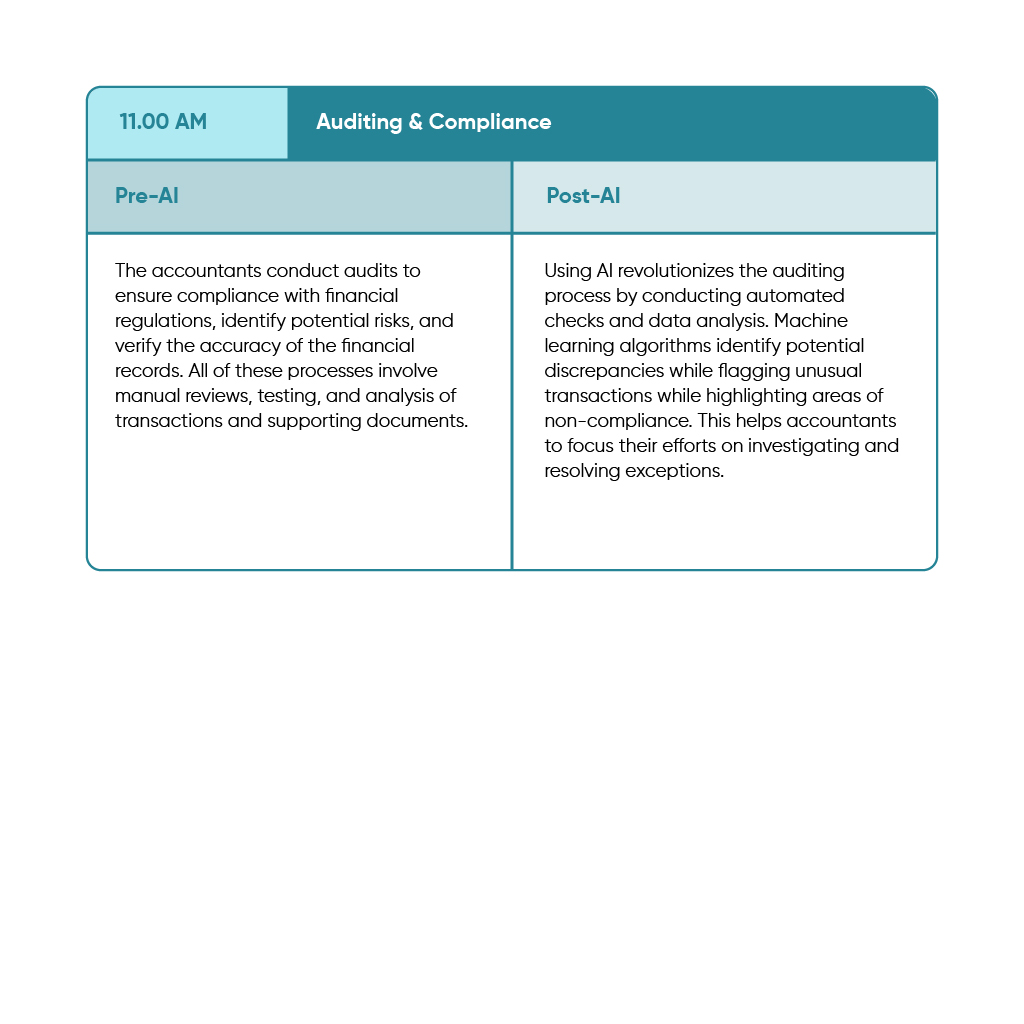

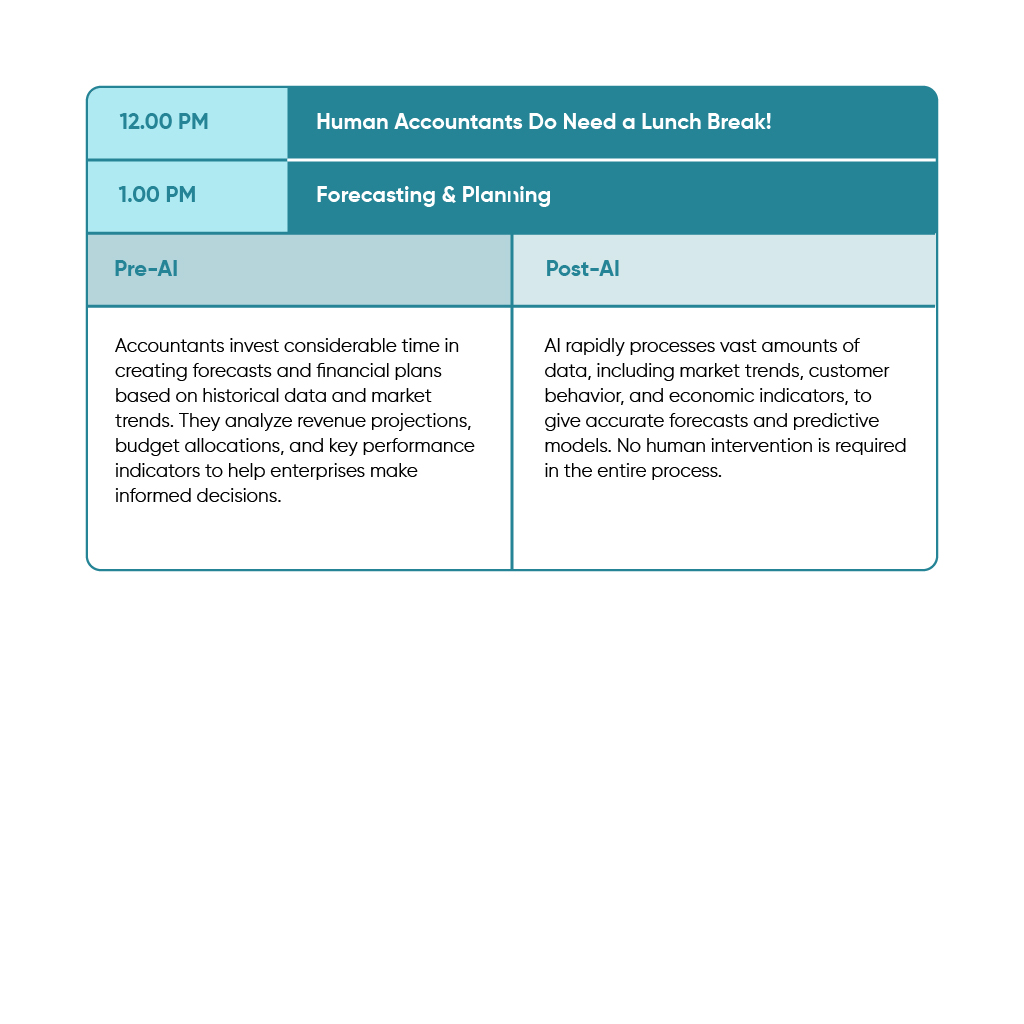

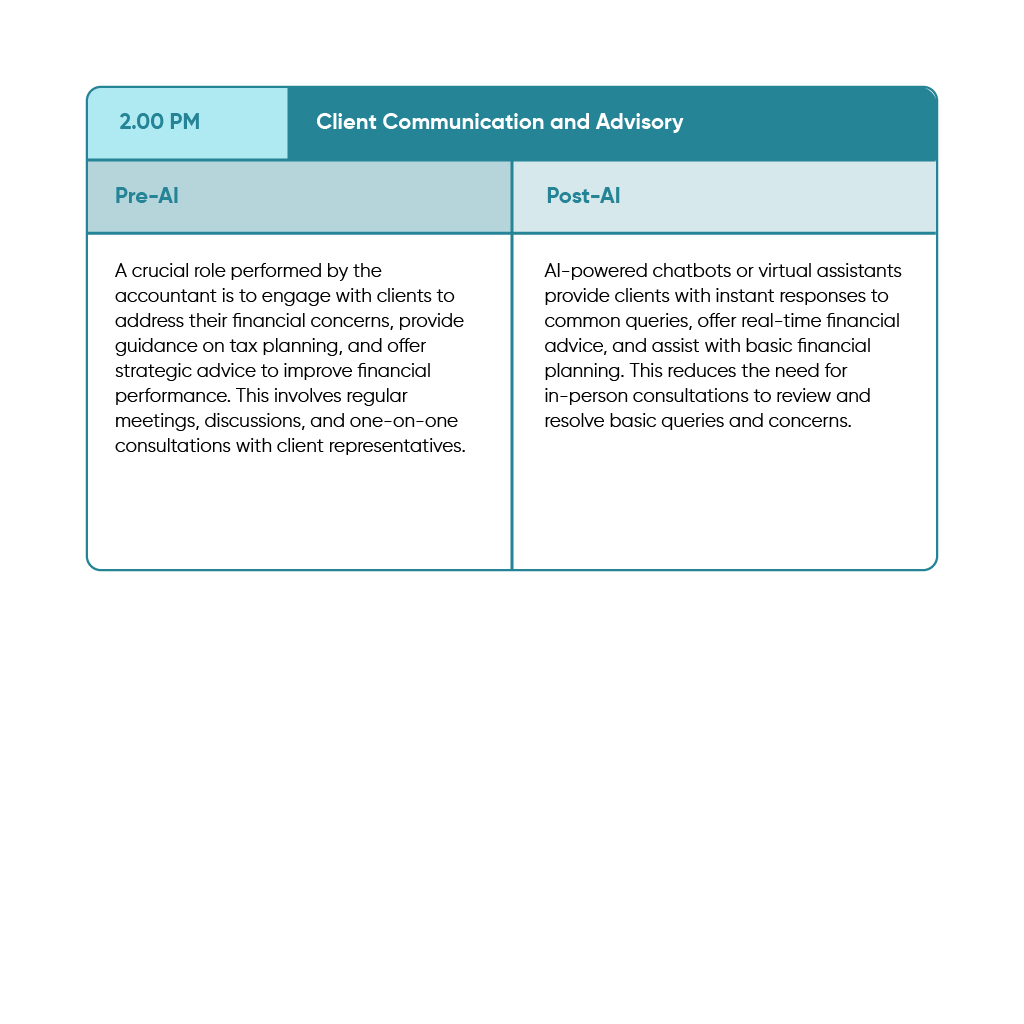

Based on these factors, if one were to map out the daily routine at an accounting practice within a mid-size organization, how would the pre-AI workflow compare with that of an AI-driven one? Here is what we found:

Instant impact – In addition to saving resource time in mundane functions, this process also ensures almost complete avoidance of data entry errors, thus building up datasets that are standardized and of high quality.

Instant impact – Apart from error-free computing based on high quality data, the pattern recognition capabilities of AI nudges human involvement based on potential errors. This saves substantial time as reviewing data is time consuming and not efficient.

Instant impact – By removing the mundane functions from the accountant’s desk, this process frees them up for deeper analysis of data and their interpretation, thus considerably enhancing their value to the organization.

Instant impact – With AI taking over the grunt work and algorithms helping identify patterns of potential discrepancies and possible non-compliance scenarios, accounts can effectively enhance the efficiencies and effectiveness of the entire audit process.

Instant impact – From data collection to analysis and insights, the AI-driven process allows the accountants the freedom and flexibility to make more informed decisions, anticipate future challenges and fine-tune financial strategies for optimal outcomes.

Instant impact – Once the basic queries and concerns are handled by AI-powered tools, the accountants can actually focus on the more complex client requirements, which helps them deliver personalized insights and deepen the relationships.

.

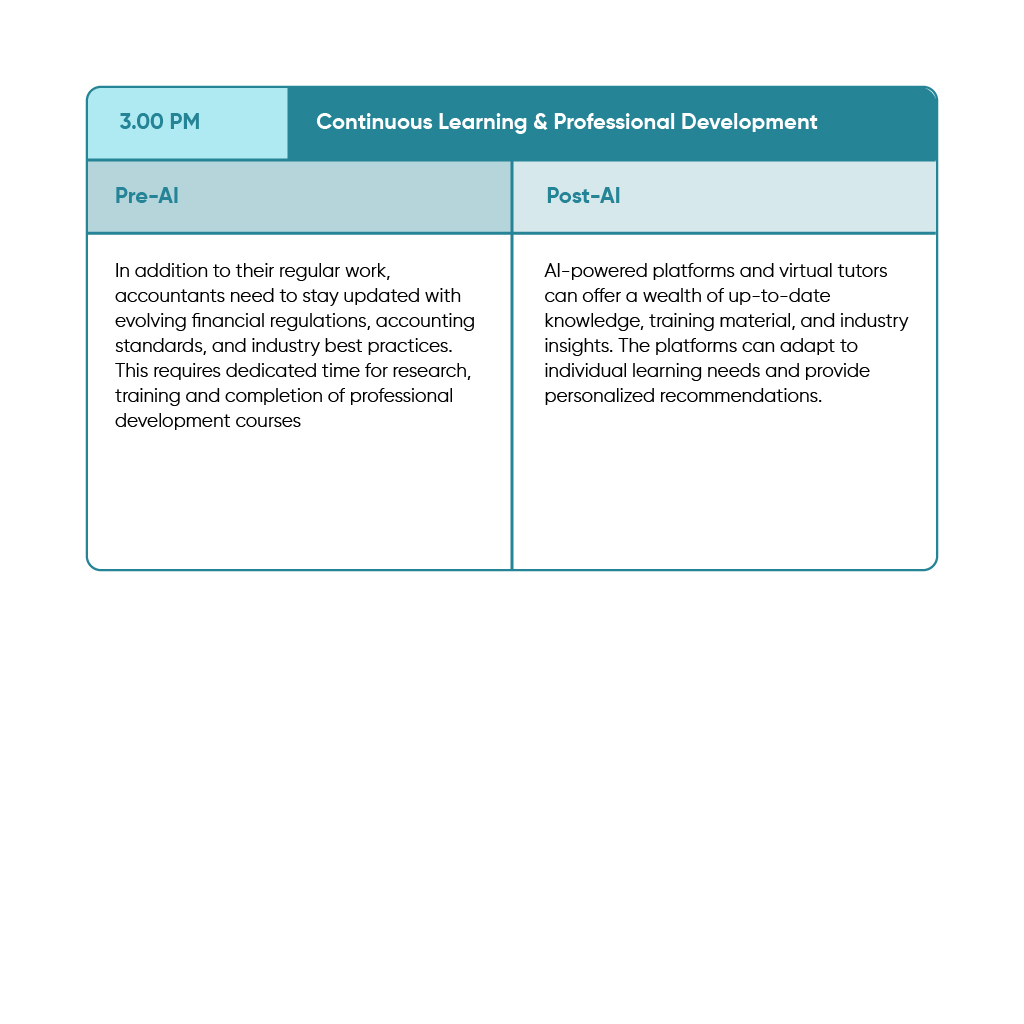

Instant impact – By providing a continuous learning experience, the AI platform ensures that professional development goes hand-in-hand with regular work. It helps accountants stay abreast of industry developments and enhances their expertise, all through a normal work day.

.

Instant impact – Given the criticality of error detection and inconsistencies in accounting, the AI-ML solution provides peace of mind to the accountants at the end of the day, while also preparing them with a prioritized list of tasks for the next.

In conclusion…

The effort here is in no way attempting to suggest that AI could make humans redundant in the accounting practice or in any business operation. Nor would machines take over accounting to a level where humans are no longer required. It is quite the opposite actually as human potential could get optimized when machines learn to perform mundane tasks that result in high levels of data integrity that results in better analytics and insights.

The two key factors that shine forth from this example include making the accounting profession itself more ‘sexier’ and inducing more people to take it up. By eliminating mundane tasks that the Gen Next would rather avoid through technology innovation, future accountants could end up playing a more strategic role in business. Additionally, it increases client-facing discussions (something that machines cannot do), which could potentially result in enhanced overall business transformation processes.