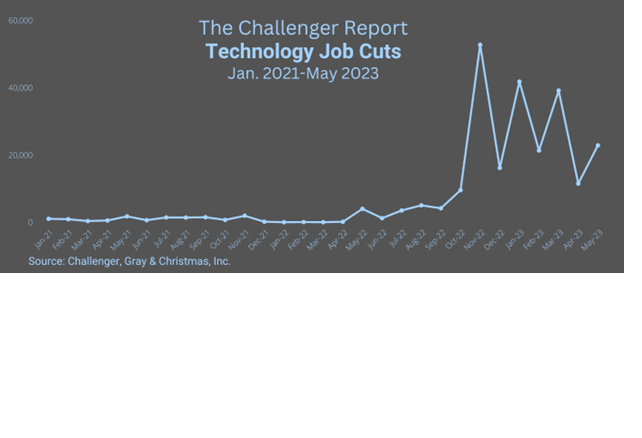

Ever since the first signs of an economic slowdown surfaced early in 2022, the global tech and IT industry has been witness to a spate of gut-wrenching job cuts. Driven by the biggest names in tech such as Google, Amazon, Microsoft, and Meta, the layoffs also percolated to mid-size companies and startups. And those who believed that the worst was over, saw more of the same in 2023. Recently updated data indicates that the total number of jobs lost over the past five months was higher than the previous year. According to Crunchbase, more than 151,000 workers in the US tech industry lost their jobs thus far in 2023.

The reasoning behind the workforce reductions have followed a common script in most cases. Companies have cited macroeconomic challenges as the immediate cause for finding discipline on the profitability path. However, tracking some of the layoffs do help us understand the impact of innovation in companies that let go of resources. While most enterprises listed cost reduction as a common cause, there are questions over whether companies are atoning for their past sins of mindless hiring.

A cursory look at the companies that reported some of the biggest workforce reductions tell a story. Amazon topped this list with 16,000 roles getting reduced, followed by Alphabet with 12,000, Microsoft with 10,158, followed by Meta (10,000) and Ericsson (8,500). The numbers from India tell another tale. Fund-starved startups in the country lost 18,000 jobs in 2022, largely as a result of funds drying up. Some of the affected companies include Byju’s, Meesho, Dunzo and a few others. In most of these cases, the reasons ranged from a need to restructure and cut costs in the wake of depleting cash reserves necessitated by the funding winter syndrome.

What began with Covid is shifting gears with AI

The surge in job cuts began during the Covid-19 pandemic. The digital transformation initiatives that were set in motion during the period of restricted mobility resulted in higher revenues as well as profits for tech giants. In spite of the waning impact of the pandemic, geopolitical uncertainties and the impending economic downturn meant that the solution remained the same even after the situation changed. Most businesses continued to explore the balance between restructuring human resource profiles and achieving operational efficiencies in the short-term. The long-term impact was never off the radar as immediate profitability took precedence over sustainable growth. The pace and scale at which companies announced layoffs, it is quite obvious that cost-reduction and immediate operational efficiencies are the current focus.

Of course, it goes without saying that some companies are using the layoffs as an opportunity to restructure their human resource profiles. The sudden reiteration of artificial intelligence (AI) and machine learning (ML) as possible options available in the digital transformation journeys is catching on with businesses reorganizing their workforce to eke out better efficiencies. Therefore, in a clutch of instances the layoffs appear to have targeted specific departments or functions that are no longer considered essential. With more than a few AI-enabled tools available and the increased digitization trends, enterprises are able to operate without advanced technological solutions if they want to stay competitive and relevant.

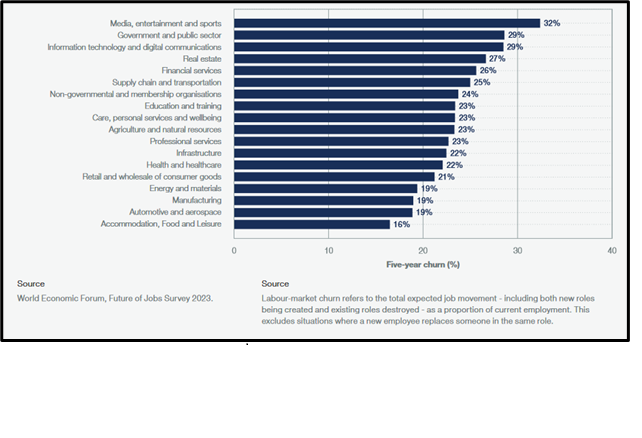

The above table makes it clear that the future of jobs that we took for granted may not exist once the full potential of AI (as it stands now) is utilized by businesses as a means to enhance efficiencies and drive better profits.

Meta, Netflix, and Uber have all laid off a number of employees in the recent past. However, the three companies also said that they would be hiring more employees in other areas, such as augmented reality (Meta), engineering (Netflix), and self-driving cars (Uber). While all three companies’ layoffs were indeed part of an effort to become more cost-effective and improve operational efficiency, they were also part of an effort to restructure their workforce(s) by deploying manpower in the areas where they would be more effective, and also in divisions where new-age technologies such as AI, ML, AR/VR etc come into play. This shows that layoffs can be used as a reorientation tool to focus on companies’ core businesses or to invest in new areas.

There’s more beyond the obvious smokescreen

However, there are also multiple instances of companies laying off employees en masse in favor of AI. The May 2023 Challenger Report found that almost 5% of tech industry job cuts for May 2023 were directly related to AI. “We do believe AI will cause more job loss, though we are surprised how quickly the technology was cited as a reason,” Andy Challenger said. IBM is reportedly planning to pause hiring for roles that can be satisfactorily performed by AI. This includes back-office and non-customer-facing roles such as human resources. All in all, AI-related layoffs in the company would number around 7800.

By and large, job cuts have been in order to boost profitability. Tech companies did extremely well in the COVID-19 pandemic, due to the increased demand for online services. Combined with the ready availability of capital for startups, this signaled that skilled workers were in demand in the tech sector and led to fierce competition to attract talent. Between June 2021 and 2022, Microsoft hired 40,000 new employees.

But with the easing of the pandemic, the geopolitical uncertainty caused by Russia’s war on Ukraine, and warnings about a global recession, the good times are over. When interest rates were very low, companies basically had endless money—and investors were telling them to focus on growth, not profitability,” said Syracuse Professor Aaron Benanav, author of ‘Automation and the Future of Work’. “But because interest rates are rising, there’s a shift from big investors to say, ‘No, now you really have to focus on profitability.’ And the big way to do that is through cuts.”

Job cuts haven’t ensured profitability in the past

Focusing on short-term profitability alone has a negative impact on long-term business. Swedish tech giant Nokia discovered this in 2008, when it decided to close down its plant at Bochum, Germany, since its labor costs had risen by 20%. The move led to protests, a government investigation and demands for subsidies to be returned, boycotts, and terrible press. The shutdown ultimately cost Nokia €200 million as compensation to the employees, and from 2008 to 2010, the company lost €700 million in sales and €100 million in profits in Germany.

According to Deepak Datta’s 2012 review of 20 studies of companies that had implemented layoffs, a majority of these witnessed declines in profitability that persisted for up to three years. Furthermore, a cross-university research team found that companies that have layoffs are twice as likely to file for bankruptcy as companies that don’t.

In 2013, telecom giant AT&T’s leaders reached the conclusion that 100,000 of its employees’ jobs would be irrelevant in a decade. But instead of resorting to layoffs, the company chose to retrain all the employees by 2020. The move paid off: by 2016, AT&T’s product development cycle time had reduced by 40%, while accelerated time to revenue had reduced by 32%.

But there is another side to this coin: while the World Economic Forum’s ‘Future of Jobs Report 2020’ said that “…AT&T has worked with Udacity to create 50 training programs designed to prepare individuals for the technical careers of the future which are distinctively relevant to AT&T’s future workforce and digital strategies,” the fact remains that as of January 2022, AT&T had cut 77,400 jobs in four years. This was in part due to CEO John Stankey’s goal of US$6 billion in cost savings.

Cost-cutting seems to be the driving force behind layoffs for a vast majority of tech companies worldwide. In the long term, this may not be wise. After all, a company risks losing not only employees, but their collective institutional and role-specific knowledge; moreover, hiring and training new employees en masse can be expensive. However, in a recessionary climate, companies may feel that their responsibility to their shareholders is paramount, and profitability appears to be the one goal that they cannot temporarily shelve in favor of long-term growth. Developing and running reskilling and educational programs at scale is also expensive, and not all companies have access to the resources of an AT&T. But while some level of churn is unavoidable, it is hard to imagine that sector-wide, global layoffs will do anything beyond allow companies to show a profit for a quarter or two.

In Conclusion…

It is safe to state that the recent wave of job cuts across the IT industry seems to be primarily driven by the need to cut costs to improve operational efficiencies in the short term. While some companies may use these layoffs as an opportunity to restructure their human resource profiles and invest in new areas, the focus on immediate profitability could have long-term consequences. History has shown that layoffs can lead to profitability declines, negative public perception, and loss of institutional knowledge. While companies may prioritize shareholder value during uncertain economic times, it is essential to consider the potential drawbacks of excessive cost-cutting. Balancing short-term gains with long-term growth and investing in reskilling programs may prove crucial for companies to navigate the evolving landscape of the tech industry successfully.

Sources

https://hbr.org/2018/05/layoffs-that-dont-break-your-company

https://us.sganalytics.com/blog/what-are-the-reasons-factors-and-impact-of-tech-layoffs-2023/