“Managers and investors alike must understand that accounting numbers are the beginning, not the end, of business valuation.” This famous comment by investment wizard Warren Buffet pretty much sums up the age-old debate around valuations and profitability. While companies can push for top line growth in its early days, the quality of its success depends only on long-term profitability. Because this is veritably the only number that denotes customer loyalty and a commitment that goes beyond what they pay for the product or service. While this could well be a cosmic reality, the challenge emerges when investors push for valuations to engineer high exits even as banks and other lenders seek healthy bottom lines. Can the twain meet?.

The profitability vs growth argument turns around

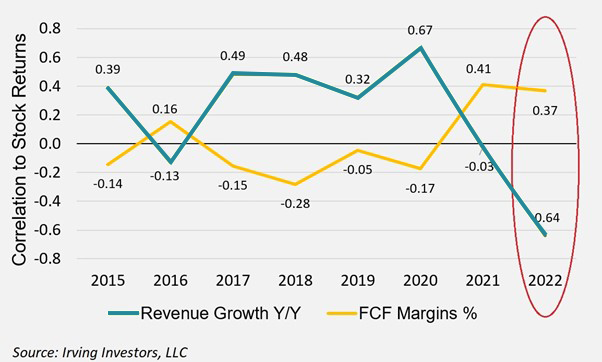

Early in 2022, an article published in TechCrunch asked, “Do public market investors prefer profitability or growth? Without actually answering the question, the article went on to suggest that recent trends suggested a pattern whereby profitability (measured by free cash flow margins) had the higher correlation to positive stock returns in the software sector.

What’s more, the data for 2021 (reproduced below) broke a four-year trend of revenue growth considered to be the most important driver for stock market performance. Besides deviating from a four-year trend, the data also suggests that the profitability correlation hit a seven-year high in 2022 while the revenue growth correlation emerged at a seven-year low.

Enterprise multiples versus value creation

In one of its research reports published earlier in 2023, McKinsey started off with a stern warning. “Beware of solving for enterprise multiples instead of value creation.” So, what is valuation or value creation? It refers to the focus on increasing the perceived value of a business, often perceived in direct correlation to market capitalization, enterprise value or potential for investment metrics. Businesses might choose to focus on valuation in order to attract investors, help secure strategic partnerships and acquisitions, enhance the business’ brand perception, and have good exit strategies.

The report goes on to state that “multiples are the result of good outcomes, but they are not the primary objective. Sometimes companies miss this essential point.” While evaluating potential strategies, it could be erroneous to rely only on earning multiples because the clear mission of strategy is to maximize long-term value. And this is where profitability makes a mark as it focuses on generating sustainable margins while optimizing the company’s finances. With profitability, businesses can potentially secure greater financial stability, operational efficiency, long-term sustainability, and shareholder value, and reduce reliance on external funding.

Given the current global economic slowdown, rising inflation, and geopolitical tensions, companies are finding it increasingly difficult to deliver both shareholder value and profits. But by deploying sharp business insights and leveraging key technologies and solutions, they can find a balance between commitments to shareholders as well as profitability.

What one sees may not be what one gets

The valuation games became increasingly popular with startups across the world over the past decade or so. Investors would insist on listening to exit plans during early-stage funding discussions itself. That the startup goes through multiple series of fund raises before eventually getting to the IPO portal meant that the founding teams of these enterprises sometimes found themselves aggressively chasing multiples.

In 2019, the implosion of America’s most valuable start-up, WeWork (now the We Company), became a case study on why companies need more focus on their bottom lines instead of chasing valuation alone. WeWork was valued at nearly US$40 billion, but lost over $1.6 billion a year. When they filed for an IPO in 2019, concerns were raised about the huge operational losses, overexposure to risk, and a lack of a clear path to profitability. The IPO attempt failed, exposing the company’s inflated valuation and its fundamental unsustainability. Too much focus on scale and valuations may help raise funding in the short-term, but without attention to the basics of business – cash flow, profits, and long-term sustainability – no company can survive, particularly in the recessionary economic environment of today.

Value for consumers vs value for shareholders

Furthermore, what shareholders and consumers see as ‘value’ has changed, particularly in view of the climate crisis. A company’s ESG commitments, the practical steps taken towards carbon-neutrality/positivity, its labor and fair-pay policies, etc, all now play into the notion of value.

“What are the values, what do you stand for, how do you want to make the world a better place, why do you exist, is much more common parlance today that it was even twenty years ago,” says Andrew Dunnett, Group Director SDGs, Sustainable Business & Foundations, Vodafone. Consumers are now making choices based on a company’s values, rather than just its ‘value’’, which has a direct impact on sales and profitability. While sustainable technologies, fair labor policies, and ESG commitments are all time- and capital-intensive investments in the short run and will reduce returns, they are crucial in building long-term value and higher profitability for stakeholders across the board.

Where can we find common ground?

A PWC study of listed companies that comprise the Bombay Stock Exchange (BSE) 100 revealed that “on average, companies that deliver better Return on Capital Employed (ROCE) – which is a comprehensive profitability metric – experience a higher valuation that is measured in terms of the price to book (P/B) multiple at which their shares trade.” This shows that often, more profitable companies end up raising a higher valuation than those that prioritize ‘growth for growth’s sake’.

Of course, a company’s balance sheet alone cannot determine the value of the assets and of the business as a whole – a valuation report is “based on either the fair market value of the assets, less the liabilities, or a capitalized value of the cash flows the company is anticipated to generate in the future”, according to Neil Weber. But the business world has come to realize that the ‘growth at any cost’ model is not only outdated but also risky. Startups must balance high growth rates with evidence of long-term profitability in order for the business to grow in a sustainable manner.

A study from 2017 by Mckinsey sheds light on how companies, particularly in the software industry, typically balance growth and profitability. Businesses that have achieved $100 million in revenue typically place less emphasis on profitability as opposed to the ones that have achieved $1 billion in sales. The latter companies focus more on profitability and sustainable growth, showing that as a company matures, it is more likely to prioritize profitability. There can be several reasons for this, but the trend is clear. Another study reinforced the idea of balancing revenues and growth for business success. It found that “revenue growth is a critical driver of corporate performance. An extra five percentage points of revenue per year correlates with an additional three to four percentage points of total shareholder returns (TSR)—the equivalent of increasing market capitalization by 33 to 45% over a decade.”

A holistic approach where the twain meet

Business leaders need to approach growth from a holistic perspective, with a three-pronged strategy: a bold, aspirational mindset, the right enablers in the organization, and clear pathways to growth defined by specific growth initiatives. Value-creating growth is driven by a focus on growing one’s core business along with a level of diversification into adjacent but related sectors to get ahead of the curve and navigate economic downturns; businesses should also work to identify fast-growing sectors and be agile enough to pivot and take advantage of tailwinds.

Having a distinctive, scalable business model is more likely to be successful and sustainable than burning cash and forgoing profits in favor of chasing growth and valuation. It’s always more practical to pursue a high Return on Invested Capital (ROIC) in order to attract and deploy more capital, and scale up in a sustainable manner. It is important to think long-term: in order to balance profitability and innovation, and maintain a growth mindset, a more calculated approach is required. Chase Harrington, president of Entrata, lists three strategies for profitable growth:

- Prioritize Research and Development: Don’t let R&D fall by the wayside in the name of cost-consciousness and cost-cutting. R&D investments are investments in your product and in the long-term health of the company. Innovation is an opportunity to differentiate yourself and stand out from your competitors. Companies like Apple, Slack, and Square are all testament to the importance of R&D and innovation investments, even during recessions.

- Focus on delivering value to customers: Keeping track of customer trends and developing insights into their requirements are key to any business. Customers are demanding real-time support that reduces time-to-value implementation. These are areas where a company should maximize on delivering value

- Data-driven decisions: Make decisions based on quantitative evidence rather than guesswork. Evidence-backed business decisions stand the highest chance of driving revenue and growth.

In conclusion…

The ‘growth-at-all-costs’ approach should be shelved in favor of one that seeks to balance growth with profitability. This ensures long-term corporate sustainability and fulfills commitments to stakeholders across the board. Ultimately, the decision to prioritize valuation or profitability depends on the specific circumstances and goals of the business. While valuation can attract investments and strategic opportunities, profitability ensures financial stability and long-term sustainability. In the initial years, startups show fast-paced growth, which can skew the founders’ outlook to over-emphasize on valuations, often pump-priming it beyond realistic levels. Burning cash to acquire customers can never be sustainable as we’ve seen in India. There’s only one real rule that businesses need to follow: Cash generated must be greater than cash consumed.