When the idea of using cloud-based infrastructure arrived on the scene, the financial institutions were amongst the early adopters, possibly because they perceived the cost savings through increased efficiencies. The same cannot be said about finance departments across other business verticals. A survey conducted by Mckinsey in 2022 revealed that barely 13% of the respondents had half or more of the IT footprint in the cloud. It further noted that just about half of them expected to shift at least 50% of their workloads to a public cloud over the next five years.

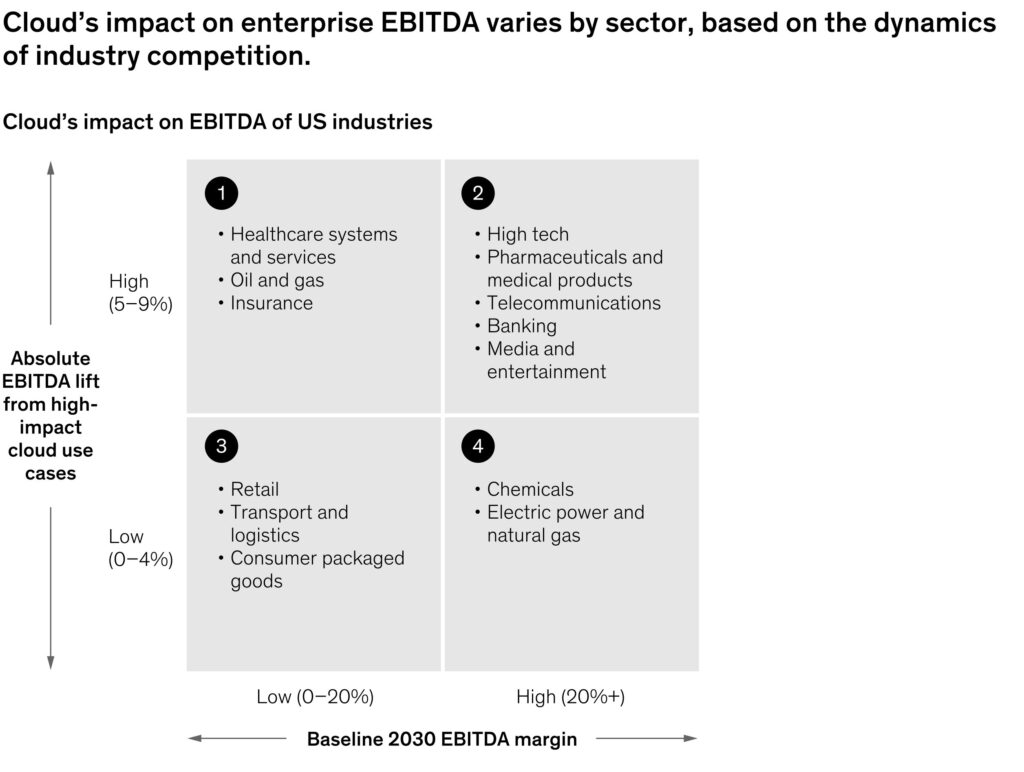

At a time when digital transformation has become the buzzword across every industry, such lethargy when it comes to the use of finance management tools could spell disaster. Of course, one could look at the glass as half-full instead and denote this shift as a sense of urgency. Which is not surprising given that another Mckinsey report noted that Fortune 500 companies alone could generate $60 billion to $80 billion in run-rate EBITDA by 2030 by taking up cost-optimization efforts using the cloud infrastructure.

What’s stopping CFOs from walking to the cloud?

Given these obvious benefits, what then could be stopping or slowing down this migration towards higher efficiencies, better data quality and sharp insights that CFOs need to nurture their organizations in a highly competitive universe? There’s good reason for this reticence, given that cloud migration is quite complex and requires much more than a financial justification amongst the multiple stakeholders in an organization. Legacy systems create comfort zones and breaking out of them needs true leadership as the CFOs would first need to convince the rest of the organization that cloud-based project management is good news.

Before getting into the details, let’s first process what financial management solutions bring to the table. These are essentially a set of tools designed to help manage daily operations while planning for the future. Most modern systems offer a suite of tools that support accounting, accounts payable, and receivable management, financial planning and analysis, budgeting, general ledger, forecasting and risk management. On the cloud, these can also provide real-time financial data.

A quick take on the pros and cons

Cloud-based financial management provides several advantages over the traditional on-premises solutions. Besides providing users with the ability to access data and reports from anywhere, anytime and via any device, it also offers flexibility to collaborate in real-time across teams, a factor that considerably enhances process efficiencies. In addition, it also allows for better informed decision-making that is collective in nature. Scalability is another factor that allows businesses to use cloud computing based on fluctuating needs, thus reducing overall costs. However, as with innovative technology, there are some challenges too, especially when it comes to implementing cloud-based solutions. A primary concern is data security as any leakage could be disastrous. The CFOs need to work with IT teams, both internal and external, to develop security solutions, while also ensuring that they partner with cloud service providers who have a good reputation in the market.

Key priorities that the CFOs need to keep in mind

Having taken a quick look at the pros and cons, CFOs also need to make some critical shifts before envisioning their cloud migration strategy. Three critical dimensions that require focus on include strategy and management, business-domain adoption and foundational capabilities. Based on which of the three they prioritize, their organization’s cloud journeys can be chalked out and traversed with considerable ease. Let’s take a quick look at how each of these three dimensions can pan out and how the CFOs can lead the way forward:

- From a strategy and management perspective, the first step would be to create the shift from experimentation to broader acceptance. Towards this end, CFOs can use lighthouses to demonstrate the future value potential and build scalability as a process across their department first and move to others later. Another option is to work with cloud service providers as partners instead of vendors by striking deals to lower entry-barriers around costs and get them to customize offerings through delivery of irresistible use cases.

- In the case of business domain adoption, CFOs need to clearly underscore the value of cloud and ensure that it isn’t treated as an IT enhancement decision. Creating cross-functional teams where business and IT work together could be a starting point though experts argue that migrating at the domain level (full product, service or a function) works better than moving disparate applications. A module approach would get better traction and also become an easily repeatable process.

- And finally, the foundational capabilities where the shift needs to happen from migrating apps to automating the process with a view to installing a hybrid ops foundation within an enterprise. Building this out requires multiple steps that remove barriers to scaling. These could include automating infrastructure processes through infra-as-code, and adoption of policies as a code and security as a code processes. These processes could allow enterprises to move into a cloud format while meeting regulatory requirements.

In conclusion…

The slow pace witnessed in the adoption of cloud-based management systems can be speeded up through evaluating and selecting the right solution. This is where the CFO’s role assumes significance, as they can scope out the financial use cases of the organization. By doing so, they can not only navigate the evaluation process, but make informed decisions that could drive operational efficiencies, cost savings, and enhanced financial control of their enterprise. In addition, the successful implementation of such a solution would also go a long way in other business verticals making the shift, resulting in a larger and more valuable exercise in digital transformation.