The digital whirlwind has disrupted workflows and processes across industries. Generative Artificial Intelligence (Gen AI) is further revolutionizing the way financial and accounting (F&A) operations are carried out. From automating tedious tasks to providing actionable insights, AI is making F&A operations more efficient and accurate.

Early Gen AI adoption is a strategic differentiator for businesses. Experts list leveraging AI among the emerging issues finance leaders and CFOs must prioritize in 2024. This article discusses the potential of Generative AI to streamline F&A processes and make them smarter for CFOs.

Future of BI – Challenges and Opportunities

What is Generative AI?

Generative AI is a subset of AI technologies that learn, improve, and reprogram themselves to mimic human problem-solving abilities. It uses Machine Learning (ML) algorithms, Natural Language Processing (NLP), and neural networks to create new content or solve complex problems.

Gen AI analyzes vast amounts of financial data to identify patterns and trends. The adaptable and intelligent algorithms use these insights to make predictions, automate processes, and generate value. From proposing budgets to data entry, reconciliations, and drafting financial reports, Gen AI frees F&A teams from routine tasks, allowing them to focus on strategic decision-making and value addition.

Driving a Strategic Vision with Gen AI

Gen AI is not a mere back-office augmentation but a strategic asset, with 89% of leaders ranking it among the top three tech priorities for 2024. It handles structured financial data with unparalleled speed and accuracy. Generative AI-powered chatbots or virtual assistants help F&A teams resolve customer queries, manage vendor interactions, and automate invoice processing.

CFOs can leverage Gen AI’s potential to redefine corporate strategy. It derives valuable information by processing large volumes of unstructured F&A data. Access to real-time and accurate data analysis makes it easier to forecast market trends, predict financial outcomes, and identify potential risks.

M&A In Healthcare: How Can AI Enhance Outcomes?

Use Cases of Gen AI in F&A

Gen AI offers a range of use cases in the F&A function. It brings a fresh perspective, accelerating the pace of operations, and minimizing the risk of human errors to provide accurate and reliable financial data.

The following are a few examples of how CFOs can use Generative AI to their advantage:

- Enterprise risk management: Risk managers can harness the power of generative AI, alongside advanced statistical methods, to analyze vast amounts of transaction data across departments. This allows for the identification of unusual patterns or outliers that might be connected to specific suppliers or operational activities and high-risk transactions. Ultimately, Gen AI tools can be seamlessly integrated into this process to distill information, enhance communication, and significantly improve the speed and quality of risk measurement and monitoring.

- Investment strategy: AI algorithms intelligently select asset combinations by considering an investor’s risk tolerance, return expectations, and current market dynamics. These algorithms analyze a broad spectrum of investment options and continuously adapt portfolios to optimize returns while minimizing risk exposure.

- Budgeting and forecasting: Gen AI models access historical data on budget allocation, expenses, revenue sources, etc., to forecast budgets. The valuable insights help in improving cost efficiencies.

- Credit risk analysis: Streamline the credit approval process by identifying potential risks in advance. Make accurate predictions on credit defaults by analyzing customer credit scores, payment patterns, and market trends.

- Financial reporting: Gen AI-powered systems can extract information from unstructured data gathered from various disparate sources to generate real-time financial reports. They ensure accuracy, consistency, and compliance with accounting standards.

- Recommended actions: The interpretations from complex datasets are further processed by Gen AI to recommend profitable actions. It helps interpret and devise accounting policies to detect fraudulent activities, forecast market trends, and comply with regulatory guidelines.

- Tailored reports: Use Gen AI’s sophisticated algorithms to produce detailed reports to meet the nuanced requirements of different stakeholders. It uses critical parameters such as revenue, expenses, profitability, cash flow, and working capital to empower CFOs and financial teams with data-driven rationale.

Gen AI in F&A Operations

Functioning through siloed systems and disparate financial processes leads to inefficiencies. Integration of Gen AI into F&A operations must be well-thought-out and carefully planned.

Gen AI can be put to work in the following categories:

- Data analysis: Generative AI excels in analyzing comprehensive data sets. It helps distill essential information from intricate documents while adhering to GAAP guidelines. Finance teams can gain deeper insights to assess financial opportunities and mitigate risks.

- Invoice processing: Automate data capture, verification, and approval with Gen AI-powered invoice processing systems. Reducing manual intervention improves accuracy.

- Vendor management: Improve relationships with vendors by automating invoice processing and vendor helpdesk management. AI ensures faster payment processing and lower error rates. Gen AI-powered chatbots drive human-like context-driven conversations to make vendor interactions empathetic. It resolves queries efficiently and brings down call duration by 50%.

- Conversation drivers: Conversational AI facilitates real-time interactions, providing instantaneous explanations for swift decision-making. Interactive financial discussions help explain financial performance to stakeholders and investors. Conversational AI enables human-like payment settlement discussions or negotiations with vendors. It can even provide personalized business recommendations by combining market dynamics information and past organizational data.

- Expense management: Reduce expense reporting and reimbursement burdens by automating employee expense audits. Identify fraudulent claims and ensure compliance with company policies.

- Journal entries: Gen AI’s text classification and NLP capabilities can help validate chart-of-accounts codes, ensure the narration adheres to company standards, and confirm that approver details are complete. Streamline the approval process and fortify the accuracy of financial records against errors and compliance issues.

- Contract and document analysis: LLMs (Large Language Models) digest and synthesize large volumes of text to increase proficiency in interpreting complex contractual documents. The model understands contract terms and conditions to provide contextual responses. Drawing upon the targeted data also recommends best accounting practices for handling royalties, leases, revenues, and commissions.

Preparing F&A Teams for Gen AI

The human element is indispensable in the adoption of technology. Adopting Gen AI means redefining roles, workflows, and even the mindset of each team member involved. Knowledge-sharing sessions, training, and leadership-led endorsements can facilitate a smoother transition.

Take the following steps to prepare your team to handle the challenges of Gen AI deployment:

- Promote reskilling: F&A professionals must adapt to technology-driven workflows. Each team member must be technically proficient and contextually aware of industry-specific nuances. Invest in their knowledge upgrade, empowering them to contribute to improving the efficiency and accuracy of Gen AI-powered processes. Professionals must be adept at steering through data-driven insights to maximize the value of their outcomes.

- Support the mindset shift: Embracing change is difficult for most humans, so it is necessary to guide your workforce empathetically. Explain that adopting Gen AI will require F&A professionals to move away from mundane tasks and augment their capabilities to focus on higher value-added activities.

- Foster collaboration: Encourage cross-functional collaboration to leverage Gen AI to its full potential. F&A professionals must work closely with IT and data science departments to make integrating new technologies smoother and more intuitive. Create a space for open communication and exchange of ideas.

- Ensure model reliability: Outcomes of Gen AI integration will significantly depend on the process of training these models. AI systems may struggle with grasping the full scope of complex F&A concepts and generate inaccurate or misleading results. It is, therefore, critical to maintain vigilant oversight by F&A professionals, along with continuous refinement of the AI models, to ensure the reliability and integrity of outputs.

- Increase human accountability: Maintaining human oversight will be paramount to verifying all Gen AI reports. It will be a safeguard against potential errors. Validation by humans will maintain trust and accountability in automated financial systems.

- Maintain controllership focus: Ensuring precision and integrity of the financial inputs and outputs is vital. Include checking for accuracy and completeness of data in the new F&A workflows. Map potential use cases of Gen AI against existing control matrices to anticipate and manage its impact on key financial controls.

Enhance F&A Efficiency with Gen AI

Generative AI is a potent tool to bolster the competencies of your F&A team. Harness its full potential through a well-strategized roadmap. F&A departments should start by identifying repetitive, time-consuming tasks that are prone to human error.

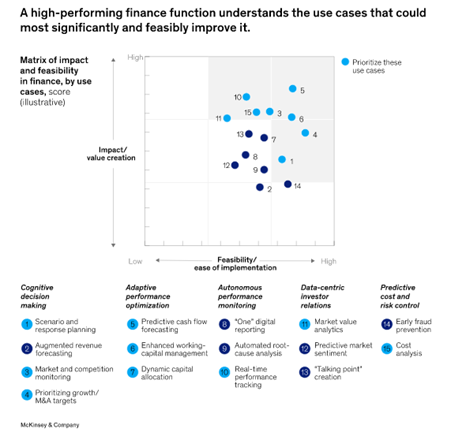

According to McKinsey, high-performing finance functions are aware of the processes that can be optimized through automation. Establishing clear strategies around deployment also includes setting measurable metrics to monitor the successes and areas for further development.

Build a roadmap for your department by analyzing Gen AI capabilities and limitations. Here are a few critical steps to consider:

- Define clear objectives: Prioritize F&A operations to be reimagined. Establish specific, measurable goals for automation and process optimization.

- Develop a plan: Create a step-by-step Gen AI integration process with timelines and milestones. Define metrics to measure the success of each phase.

- Prioritize user training: Invest in extensive training programs for F&A teams to maximize the benefits of Gen AI systems.

- Ensure data readiness: Quality data drives effective AI outcomes. Verify that data sets are clean, comprehensive, and organized to feed the Gen AI systems accurately.

- Focus on Key Performance Indicators (KPIs): Regularly monitor KPIs to make informed strategy adjustments. Strive to improve outcomes continuously.

A Giant Leap

Gen AI addresses unique challenges and goals for every organization. For proper integration, F&A teams should partner with a tech solutions provider having expertise in deploying Gen AI for finance functions. They can guide CFOs through the transformation with well-laid processes and the right set of AI-powered tools. They evaluate the organization’s learning curve, data readiness, and strategic objectives to develop a comprehensive plan to harness Gen AI’s potential.

Towards Net Zero: Value Creation in the Automotive Supply Chain